Step-by-Step Guide to Create GST Reports

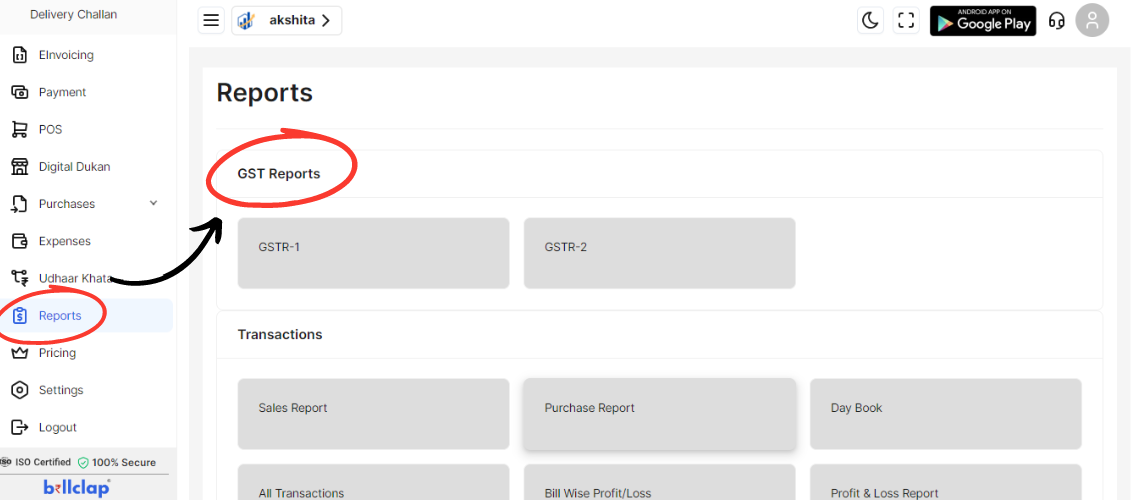

Go to Reports Section on Dashboard:

Log in to your account on the dashboard.

Navigate to the main menu or dashboard area.

Click on the “Reports” section to access various report options.

Select GST Reports:

In the Reports section, locate the option for “GST Reports.”

Under GST Reports, you will see two categories:

GSTR-1

GSTR-2

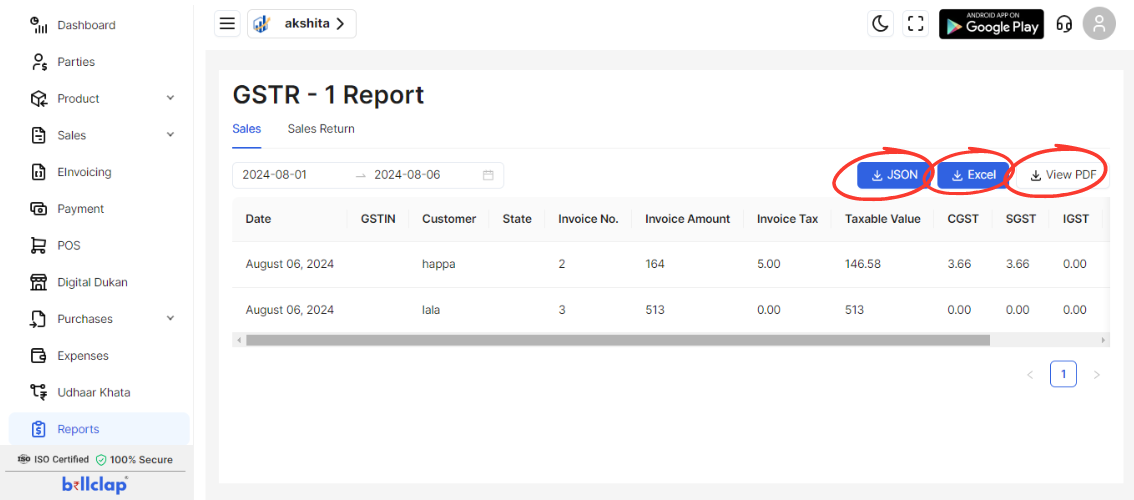

Choose Report Type:

Click on the category you want to create, either GSTR-1 or GSTR-2.

Fill in Sales Details:

If you selected GSTR-1, you will see two options: Sales and Sales Return.

Click on Sales to enter details:

Date: Enter the date range for the sales report.

GSTIN: Provide the GSTIN number.

Customer: Enter the customer name or details.

State: Select the state where the sale occurred.

Invoice No.: Enter the invoice number.

Invoice Amount: Input the total amount of the invoice.

Invoice Tax: Enter the tax amount on the invoice.

Taxable Value: Provide the taxable value of the invoice.

CGST: Enter the Central GST amount.

SGST: Enter the State GST amount.

IGST: Enter the Integrated GST amount.

CESS: Input any CESS amount if applicable.

Total Tax: Calculate and enter the total tax.

Search and Download Reports:

Use the calendar bar to search and filter the report by date or other criteria.

Choose to download the report in various formats:

JSON

Excel

**PDF

Fill in Sales Return Details:

Click on Sales Return to enter the relevant details:

Date: Enter the date range for the sales return report.

GSTIN: Provide the GSTIN number.

Customer: Enter the customer name or details.

State: Select the state where the return occurred.

Invoice No.: Enter the invoice number for the return.

Invoice Amount: Input the total amount of the return invoice.

Invoice Tax: Enter the tax amount on the return invoice.

Taxable Value: Provide the taxable value of the return invoice.

CGST: Enter the Central GST amount for the return.

SGST: Enter the State GST amount for the return.

IGST: Enter the Integrated GST amount for the return.

CESS: Input any CESS amount for the return if applicable.

Total Tax: Calculate and enter the total tax for the return.

Search and Download Reports:

Use the calendar bar to search and filter the sales return report by date or other criteria.

Choose to download the report in various formats:

JSON

Excel

PDF

Verify Reports:

Review the generated reports to ensure all details are accurate and complete.

Confirm that the reports are correctly saved and available in the selected formats.