In Billclap, customization options for invoices are designed to help users tailor the appearance and content of their invoices to reflect their brand identity and meet specific business needs. Here’s a detailed explanation of the customization options typically available in Billclap invoices:

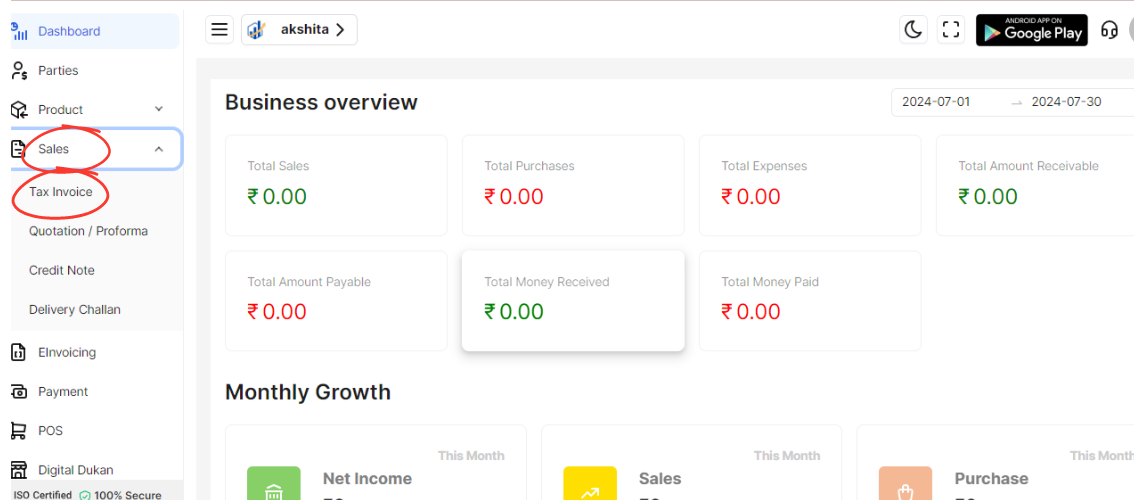

Navigate to Sales Column:

Log in to your BillClap account.

Go to the Sales or Invoices section.

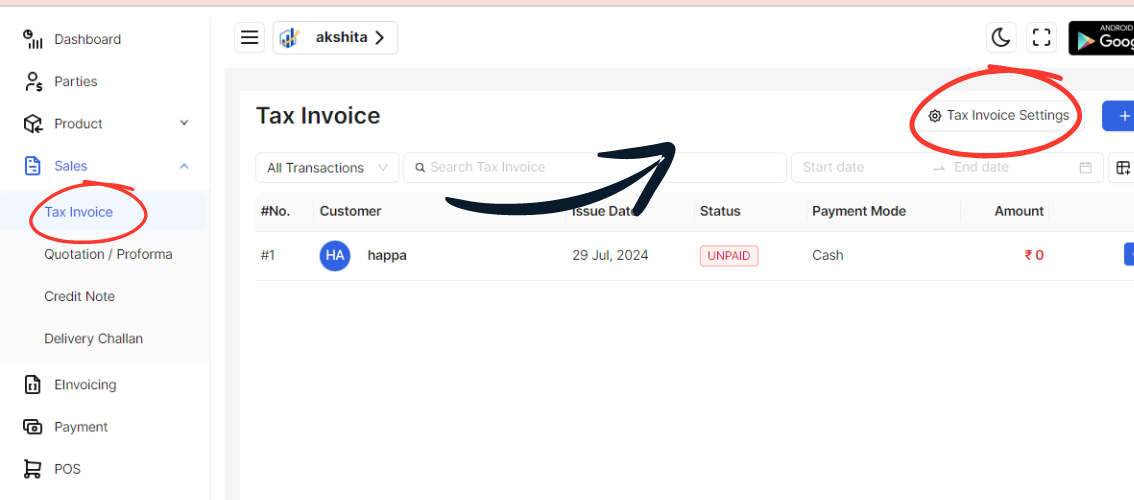

Access Tax Invoice Settings:

Find and click on the option Tax Invoice settings. This is usually located under settings or configurations within the Sales section.

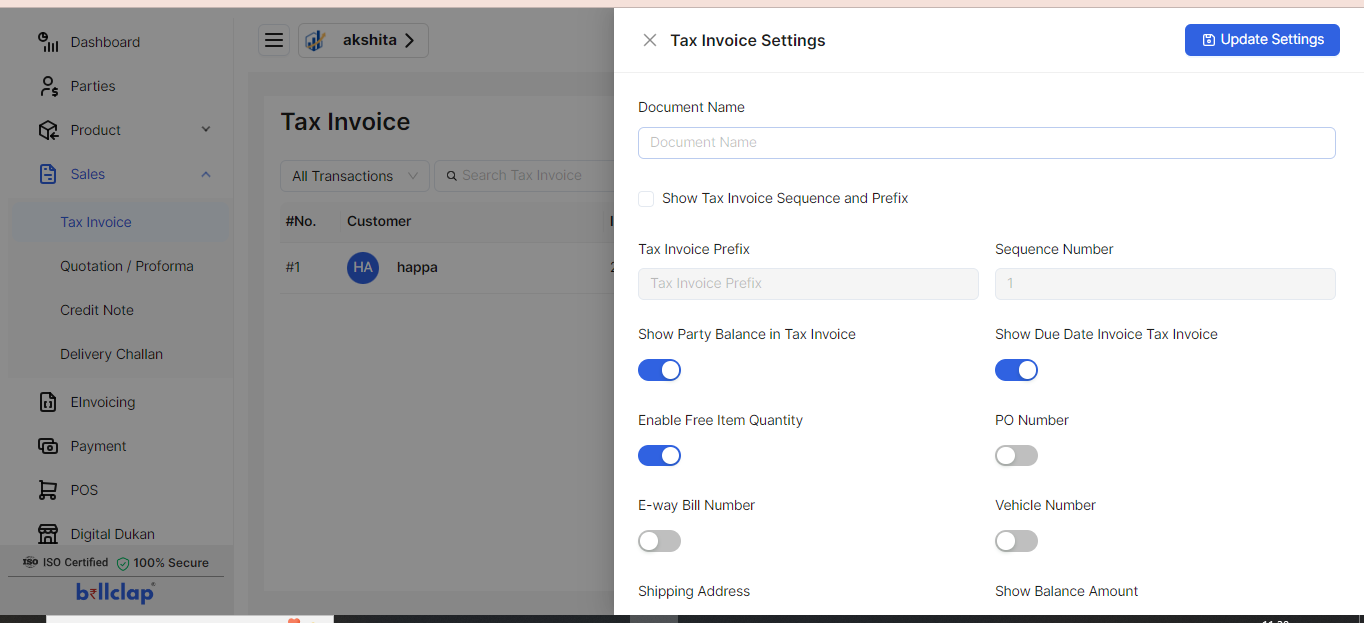

Fill in Document Name:

Enter a suitable Document Name for your tax invoices. This could be "Tax Invoice", "Invoice", or any specific name you prefer.

Configure Tax Invoice Sequence and Prefix:

Locate the settings for Tax Invoice Sequence and Prefix.

Enter a Prefix if needed (e.g., "INV-").

Specify the starting Sequence Number for your tax invoices.

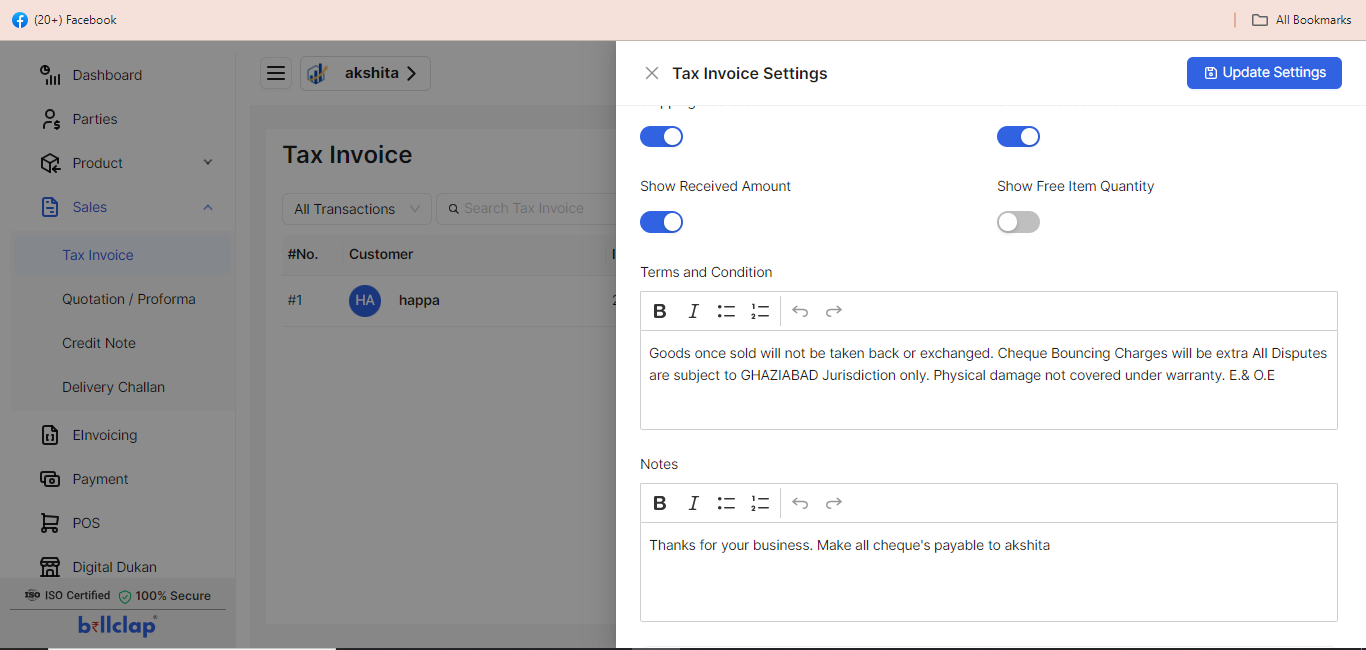

Enable/Configure Optional Settings:

Check or fill in the following optional settings as required:

Show Party Balance in Tax Invoice: Enable this option if you want to display the customer's current balance on the tax invoice.

Show Due Date in Tax Invoice: Enable this option to display the due date of the invoice.

Enable Free Item Quantity: Check this box if you want to include free item quantities on the invoice.

PO Number: Enter a field for Purchase Order numbers if relevant.

E-way Bill Number: If applicable, enter the E-way Bill Number field.

Vehicle Number: If shipping goods, enter the Vehicle Number field.

Shipping Address: Specify if you want to show the shipping address on the tax invoice.

Show Balance Amount: Display the balance amount on the invoice.

Show Received Amount: Display the received amount on the invoice.

Show Free Item Quantity: Display the quantity of free items on the invoice.

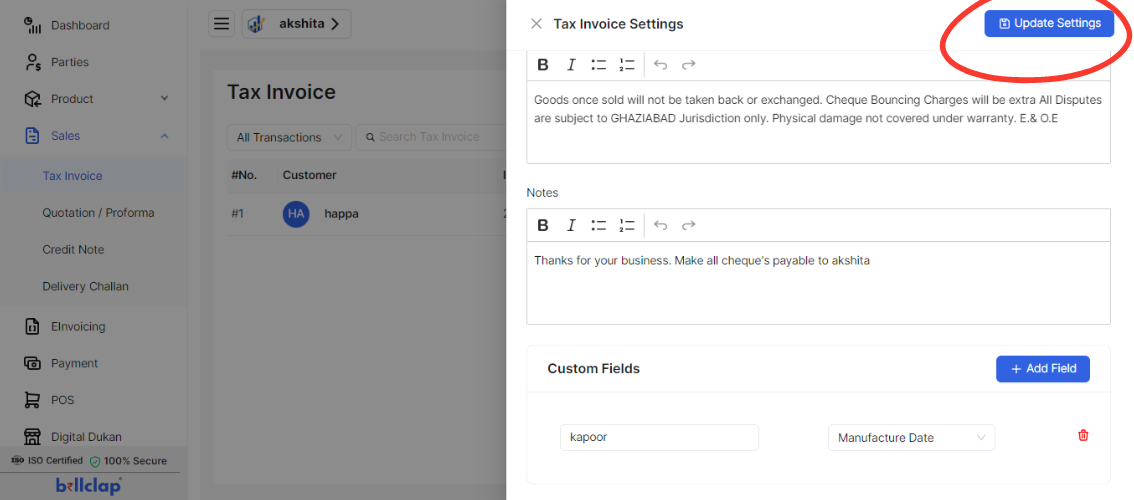

Terms and Conditions: Enter any terms and conditions that should appear on every tax invoice.

Notes:

If there's a specific Notes section or field, fill it out with any additional information or instructions relevant to the tax invoice.

Save Settings:

After filling out and configuring all the necessary settings, make sure to save your changes. This is usually done by clicking on a "Save" or "Update" button at the bottom of the settings page.